There are so many things you’ll need to adjust to once you get married. One major issue is managing money. Who answers for daily expenses such as groceries, rent, or date nights? What about major milestones such as your dream home, furniture, or your much needed home renovation? Starting a new life together can sure be exciting but it can also be challenging when it comes to paying the bills. Today, we’re giving you four money tips for a smoother transition as you embark on your new life together.

Money issues start cropping up the moment you plan your dream wedding and extends up to building your new home. But remember not to get carried away. Before hiring that sought-after wedding supplier, you should know and agree on the things you’ll prioritize spending on as a couple. List everything down, all your needs and wants, and rank them accordingly based on your budget. Once you see everything on paper, it will be easier to make the purchase based on your budget.

You’re about to be a couple so this means that you’ll soon be thinking of everything times two. From the small everyday things like toiletries and especially grocery shopping. Purchase items that are sharable depending on your needs. This way, you’ll get more value for your money.

Saving for the future is easier said than done. There’s a saying that what we earned for a month can quickly be gone in just one swipe. Both of you should agree on an amount to be saved every month. Commit to it and you’ll eventually get into the habit of saving a portion of your money for the rainy days.

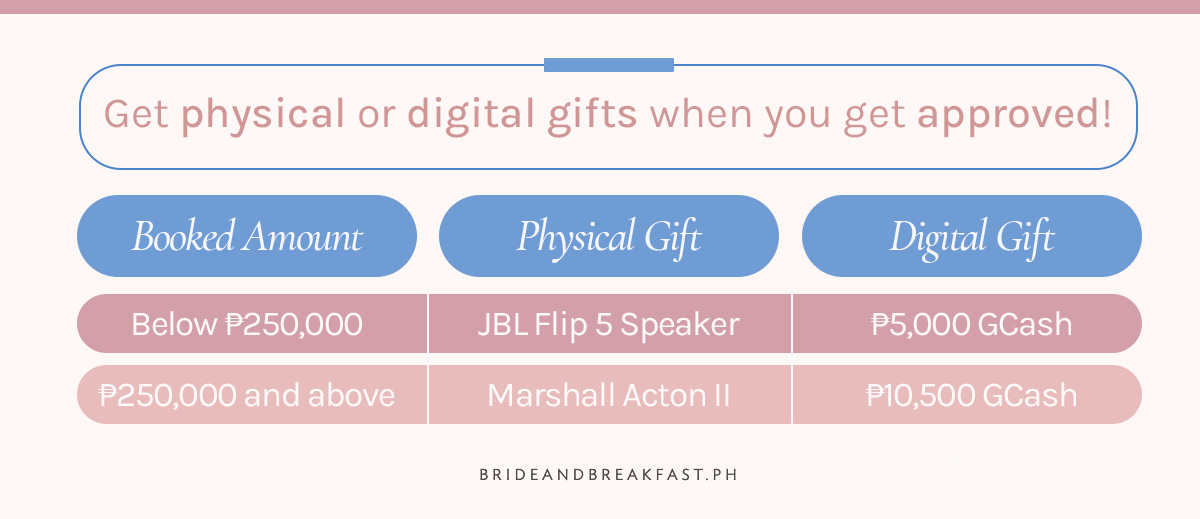

Starting a new life together can be daunting. Going from milestone to milestone also means incurring expense after expense. So how do you balance your funds so that some expenses are investments? One way is to make a personal loan with a low interest rate so you can break your large payables into smaller monthly due dates. The good news is Citibank currently offers a personal loan that has interest rates as low as 1.26%. Depending on the final amount you’ll borrow, you can even choose a physical or a digital gift once your loan gets approved.

Once you’re ready to take the next step, click on this link to apply for Citibank’s Personal Loan and avail of the gift once approved. Promo runs from May 1 to 31, 2022 under DTI Fair Trade Permit No. FTEB-142271 Series of 2022. For more information, refer to the FAQs.